[Set Slide Image]

PD Pathways

PD Pathways is a monthly digital newsletter for CPAs and business professionals, showcasing the latest news and resources in CPABC Professional Development.

New to ESG? SASB’s Materiality Finder Can Help

By Mia Maki, BA, MBA, FCPA, FCMA

As CPAs get serious about measuring corporate environmental, social, and governance impact, also known as ESG metrics, it can be helpful to know that there are tools to help us narrow down the endless possibilities.

SASB is the Sustainability Accounting Standards Board, a not for profit organization based in San Francisco, that develops sustainability accounting standards primarily for US public companies. SASB restructured its governance in 2017, to mirror FASB and IASB’s structure[1], and released its first ESG reporting standards in 2018[2].

SASB’s website has a few online tools, including the Materiality Finder. This tool allows you to look up, by industry, relevant issues that would drive requirements for ESG metrics, for public companies in a specific sector. You can find metrics that your company should consider in two ways:

- Search by industry; or,

- Search by company.

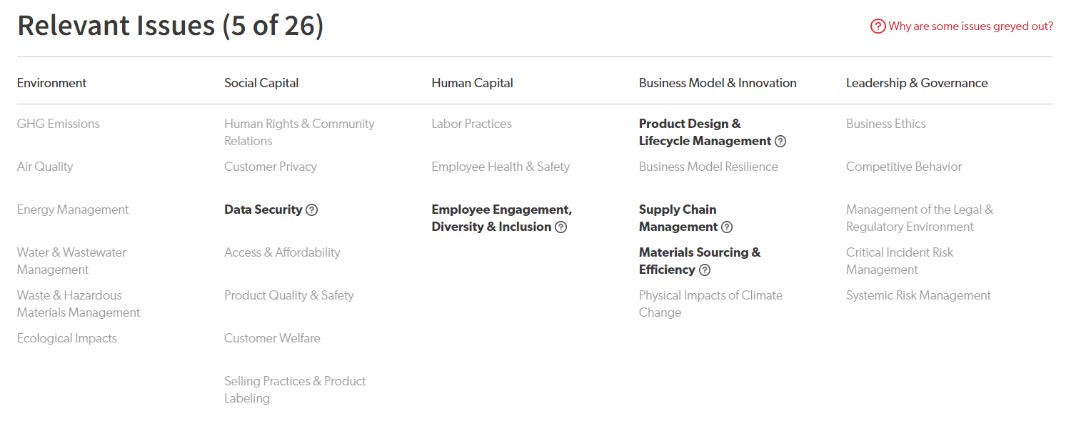

For example, if your company is in the telecommunications hardware industry, you could look up Apple by name, or use their stock ticker, AAPL. Alternatively, you could search the “Find Your Industry” section, selecting “Technology and Communications” followed by “Hardware Industry”. Either way, the Materiality Finder delivers a parsed list of relevant issues for which metrics for ESG are recommended. In the sample below, the number of relevant issues has been reduced from a potential list of twenty-six (26), down to five (5) – a wonderful time savings for a busy Controller or CFO.

Source: SASB. Materiality Finder > Find Industry Topics > Apple Inc.. Accessed March 17, 2022. Table. Sasb.org. https://www.sasb.org/standards/materiality-finder/find/?company[]=US0378331005

You will note that each relevant issue has a question mark to its right; a rollover, explaining each in more depth. Further information is available, in a section below, called Information Disclosures, and the full standard for the industry can also be downloaded.

From there, you can review the annual reports and SEC filings for the public companies in your industry, to get specific ESG metric ideas for each issue. The Materiality Finder kickstarts your journey to identify some initial ESG metrics, and provides a comprehensive map of the key areas that, over time, you will want to address. In other words, you get an opportunity to create your first ESG metrics, now, and you have a list of all relevant issues, to fill in the gaps for the future.

There are other tools on the SASB website including a Materiality Map. It can all be accessed here: https://www.sasb.org/standards/materiality-map/. If you are interested in better understanding the need for CPAs of non public companies to learn about ESG and adopt metrics for your company, the following articles are helpful: Understanding the need for an ESG strategy; Doughnut Economics and the push for regenerative, distributive systems; Why ESG matters for CPAs.

ESG is a new, exciting frontier for CPAs. In addition to tools like the SASB Materiality Finder, connect with your network of other CPAs to share best practices, so that all BC companies are ready for the future.

[1] Michael Cohn, “SASB reconfigures board structure,” Accounting Today, May 11, 2017, https://www.accountingtoday.com/news/sasb-reconfigures-board-structure.

[2] Nina Trentmann, “SASB Launches Sustainability Accounting Standards”, CFO Blog, Wall Street Journal, November 7, 2018, https://www.wsj.com/articles/sasb-launches-sustainability-accounting-standards-1541603218.

.png) MIA MAKI, BA, MBA, FCPA, FCMA is a Principal of a consulting firm and a Professor with the University of Victoria Gustavson School of Business, with over 25 years of teaching experience. She has worked in Finance and Accounting since 1986 and has experience in a wide variety of industries, including audio technology, airlines and aviation, not-for-profit, public accounting, marine transportation, fisheries monitoring, gaming and other technology arenas. She has worked for both private and public companies, has participated in raising over $50M in funds, and has experience in international initiatives.

MIA MAKI, BA, MBA, FCPA, FCMA is a Principal of a consulting firm and a Professor with the University of Victoria Gustavson School of Business, with over 25 years of teaching experience. She has worked in Finance and Accounting since 1986 and has experience in a wide variety of industries, including audio technology, airlines and aviation, not-for-profit, public accounting, marine transportation, fisheries monitoring, gaming and other technology arenas. She has worked for both private and public companies, has participated in raising over $50M in funds, and has experience in international initiatives.

Learn more from Mia at one of her upcoming sessions this Spring/Summer: Controller's Operational Skills Program; Strategic Management Certificate Program (SMCP); Advanced Strategic Management Certificate Program - Maps

Upcoming Accounting and Assurance Seminars

Here are some seminars in accounting and assurance topics coming up soon. Don’t miss the new seminar on ASPE – Revenue Recognition 3400!

Quality Management – Overview of CSQM 1 and 2 for Providers of Assurance Services (New Standards)

This seminar will provide an overview of the requirements of the newly issued Canadian Standard for Quality Management (CSQM1 and CSQM2) and related amendments to Canadian Auditing Standards (CAS 220) and its impact on the quality control processes for assurance practitioners.

Read more about Quality Management – Overview of CSQM 1 and 2 for Providers of Assurance Services

ASPE - Revenue Recognition 3400

This seminar will provide an overview of the requirements of the newly issued Canadian Standard for Quality Management (CSQM1 and CSQM2) and related amendments to Canadian Auditing Standards (CAS 220) and its impact on the quality control processes for assurance practitioners.

Read more about ASPE - Revenue Recognition 3400

Compilation Engagements - Application of the New CSRS 4200

This seminar will include hands on opportunities to review application of standard to different scenarios, comparison with previous standard and with other non-assurance standards.

Read more about Compilation Engagements - Application of the New CSRS 4200

Compilation Engagements - Overview of the New Standard (CSRS 4200)

This seminar will provide an overview of the requirements of the new Canadian Standard for Related Services (CSRS) 4200 and its impact on the planning, implementation and documentation of a compilation engagement.

Read more about Compilation Engagements - Overview of the New Standard (CSRS 4200)

Don’t forget to check out our large selection of online on-demand courses in accounting and assurance.

Seminars with Ethics Content Available in Early May

Still looking for ethics content? Here are 3 ethics seminars taking place in early May. You’ll want to register soon to ensure your spot!

Becoming an Ethical Leader

Gain insights into becoming an ethical leader, and how that translates into becoming a more effective and respected leader. Explore the critical role ethical leadership plays in creating the ethical climate in organizations.

Read more about Becoming an Ethical Leader

Shades of Grey: Ethics in the Workplace

This course offers an introduction to understanding and managing ethical issues in a business setting. Explore the intersection amongst prominent theoretical approaches to ethics, personal values, business values and how they shape business decisions.

Read more about Shades of Grey: Ethics in the Workplace

A Threats and Safeguards Approach to Ethical Decision Making

Explore situations in our professional roles that involve ethical challenges and examine how these can pose threats to our compliance with the Fundamental Principles under the CPABC Code of Professional Conduct.

Read more about A Threats and Safeguards Approach to Ethical Decision Making

Incorporating Risk Management in Operations

In our increasingly complex environment, it is critical that finance professionals understand and embrace risk management as a key discipline. Learn how to properly manage risk to create a thriving business, generate value, and achieve a competitive advantage.

Enterprise Risk Management Fundamentals (Executive Program)

This three-day, seven module program has been designed to help finance leaders anticipate, prepare for, and quickly respond to evolving business threats and opportunities. The program will be especially valuable to those financial professionals in organizations and industries where risk management is gaining critical importance.

Watch a video interview with Bill Wesioly, the facilitator for this program.

Register for Enterprise Risk Management Fundamentals today!

Five Ways to Promote Engagement and Retention in the Workplace

While the Great Resignation may not have hit Canada in the same way as the United States, we are nevertheless facing a worsening labour shortage here in BC. On paper, the reasons individuals leave their employers are not very different on paper pre-COVID versus today – changes to familial commitments, stress, professional and personal growth, and general dissatisfaction. But it’s this last reason – dissatisfaction – that seems more prevalent now as we reach the second anniversary of the pandemic.

Fortunately, there are some relatively simple shifts that managers and leaders can consider to foster a culture of engagement and ultimately retention. Here are five ways to do just that.

Understand and actively encourage collaboration

At its core, collaboration means a group of individuals working together to achieve a goal. But as a leader, are you taking the proper steps to creating a true collaborative team? Effective collaboration isn’t limited to simply scheduling weekly team meetings, it includes creating a proper culture and fair workflows, understanding the team and its diversity, aligning teams to projects, and building in time for proper feedback. By having true collaboration, teams can benefit from improved communication, shared learnings and experiences, and feeling included in a shared culture.

Learn more about Achieving Results Through Collaborative Projects

Run virtual meetings people want to attend

The hybrid work model is likely here to stay. While the issue of disengagement among certain employees has been nothing new for the past two years, the relative permanence of hybrid work means that it’s important to seriously address “virtual disengagement”. We all do it sometimes - it’s tempting to turn your camera off during meetings and continue working on the side. Yet in the long run, this can make meetings increasingly ineffective and frustrating for everyone. Be honest about how big an issue this really is in your team or organization, then explore best practices and recent research on new and innovative ideas on how to run effective virtual meetings.

Learn more about Dispelling the Myth of "Effective Meetings": Engaging Virtual Meetings Your Employees Will Want to Attend

Identify barriers to virtual team performance

Ineffective virtual meetings are not the only challenge to the hybrid work model. Leaders and employees face other barriers that can affect work performance – from home distractions, self-discipline, dispersed physical locations, inconsistent work hours, to lack of proper technologies and other office attributes. Properly diagnosing and then working to overcome these barriers is a key step to fostering more employee engagement, and ensuring your virtual team’s future success.

Learn more about the Seven Steps to Successful Virtual Teamwork

Use delegation properly as a tool for engagement

Improving how we work together virtually does not solve all the issues related to a lack of engagement. At the end of the day, individuals feel truly engaged when they have some form of accountability and empowerment over their responsibilities. Delegation is not a skill that leaders should use with only their own efficiencies in mind – done well, it can be the difference-maker in driving employee performance, engagement, and ultimately retention. Are you delegating too much or too little? Are you delegating to the right people? Is the delegation equitable? Effective delegation can lead to greater clarity in communication, accountability, participation, and empowerment – all important ingredients in creating a truly engaging environment.

Learn more about Employee Delegation, Engagement and Empowerment

Create empowerment through your management style

Management styles can impact working relationships, with more passive styles often leading to lower employee engagement. Empowerment enters the frame again here as individuals who are consistently given constructive feedback and made to feel more involved in their roles, will more likely develop a sense of empowerment over their own growth in the organization. A coaching type of management, based on effective listening and questioning techniques, is one example of a leadership style that can contribute to a more supportive, empowering, and engaging environment in many diverse situations.

Learn more about Empowering and Engaging Others

Enhance your ESG knowledge with CFI

Corporate Finance Institute (CFI) is the leading, accredited provider of online courses, certifications, and technology solutions for finance professionals. Kyle Peterdy, MBA, BEd, has been with the firm since 2020, designing and delivering unique, hands-on e-learning experiences, including courses and case-based simulations.

.png) Kyle's background is in commercial banking, where he was responsible for originating and underwriting middle market credit transactions. He has extensive experience with real estate lending and construction project financing, where part of his role was assessing physical environmental risks. Kyle has a BEd from McGill University and an MBA from the Sauder School of Business at UBC. He is a passionate advocate of moving ESG issues from the periphery of C-suite discussions to the forefront of strategy, business continuity, and risk management planning.

Kyle's background is in commercial banking, where he was responsible for originating and underwriting middle market credit transactions. He has extensive experience with real estate lending and construction project financing, where part of his role was assessing physical environmental risks. Kyle has a BEd from McGill University and an MBA from the Sauder School of Business at UBC. He is a passionate advocate of moving ESG issues from the periphery of C-suite discussions to the forefront of strategy, business continuity, and risk management planning.

CFI in partnership with CPABC PD offers you four webinar titles on ESG. Here is what Kyle has to say why ESG should matter to you.

Why is it important for participants to learn about ESG, now more than ever?

ESG, as a field of analysis, has historically been viewed mostly through the 'E' lens (Environmental). The analyst community specifically, and stakeholders of all stripes (more broadly) are finally realizing that ESG goes well beyond understanding carbon emissions. ESG risks and opportunities are business risks and opportunities, period; understanding and quantifying these effectively will set the best, most forward-looking companies apart from those that are unable to do so.

What’s one of the key ways these seminars will help CPAs in their career?

CFI's ESG curriculum has been designed to provide participants with a keen understanding of what ESG is all about. It goes beyond the traditional prescriptive approach to corporate training, meaning we don't just teach learners to use specific tools; rather, we equip our participants with critical thinking skills and practical frameworks that they can apply to many different types of unique situations and challenges.

Is there a current challenge that your seminars will help address?

ESG evolved from a variety of predecessor movements like the Triple Bottom Line and Corporate Social Responsibility, but it's much more than just a buzzword in today's political, economic, and physical climate. ESG is about sustainability, and our training is about helping organizations understand sustainability more completely and more comprehensively.

What is a key opportunity your seminar offers?

CFI's ESG curriculum will support the analyst and the advisory community in having more detailed conversations with clients and prospects while enhancing their ability to conduct much more robust financial analysis.

Tell us about one takeaway that you are really excited to share with your audience.

I think it's really just the breadth of content that we've been able to offer, and that we're continuing to develop. Whether it's understanding ESG disclosures and how to avoid Greenwashing, integrating ESG factors into a financial model, or understanding how human capital management best practices can impact a company's bottom line, we've taken a really unique approach to help people understand what ESG is all about.

Why ESG Should Matter to You

Listen to Coffee Chats with CPABC podcast episode with Lori Mathison, FCPA, FCGA, LLB, president and CEO of CPABC, and Sarah Marsh, CPA, CA, partner with PwC Canada’s Sustainability and Climate Change team in Vancouver and national lead for their ESG Reporting group, as they discuss why it’s important for CPAs to understand ESG and the critical role they can play in ESG reporting.

PD Pathways

Reminder

Your PD Passport credits will expire on August 31, 2022.

Use your credits today! View our spring/summer catalogue or our view-by-month course calendar for a complete list of seminar titles. Need flexible learning options? Learn anywhere, anytime with our on-demand webinars by CPABC and our online learning partners.

To view your outstanding passport credits, login to your member profile in Online Services, click on the “Professional Development tab", and select “View Passport Statement” from the menu on the right.

Did You Know?

We have a new on-demand learning partner!

Education 4 Sustainability (ED4S), designs, builds and distributes entertainment driven, visually engaging, on-demand courses in Sustainable Finance and on Environmental, Social, and Governance (ESG) topics in the business context.

ED4S in partnership with CPABC PD brings you two highly visual Video on-demand titles on:

.png)